Author Email:

For the a statement, a business spokesperson blogged: “The brand new Duncan family members adheres to most of the appropriate tax legislation and can perhaps not  comment on private taxation statements, that are a personal amount.” Cornyn’s workplace didn’t answer questions in regards to the senator’s modification.

comment on private taxation statements, that are a personal amount.” Cornyn’s workplace didn’t answer questions in regards to the senator’s modification.

This new income tax split stems from end once 2025, and an excellent gulf of mexico possess exposed inside the Congress regarding way forward for the fresh new supply.

, advised rules that would prevent the taxation reduce early into ultrawealthy. In reality, people and work out over $500,100 a year manage no further get the deduction. Nonetheless it might possibly be expanded on the business owners less than you to endurance that happen to be currently omitted due to their community. The bill do “make coverage a great deal more fair much less advanced to have center-class advertisers, while also raising billions having priorities including childcare, degree, and you may medical care,” Wyden told you within the a statement.

Meanwhile, those trading groups, for instance the Chamber away from Commerce, is moving to help make the solution-by way of income tax reduce permanent. This season, a beneficial bipartisan expenses known as Chief Street Tax Certainty Act are delivered both in home out of Congress to-do just that.

ProPublica acquired the fresh new replace after suing the new Treasury Agencies

One of the bill’s sponsors, Agent. Henry Cuellar, D-Tx, pitched the fresh rules that way: “I am dedicated to taking vital relief in regards to our nation’s quick enterprises in addition to groups they suffice.”

Do you have expertise in taxation legislation, bookkeeping or wealth administration? Have you got suggestions to show? Here’s how for connecting. The audience is trying to find both certain info and you may greater solutions.

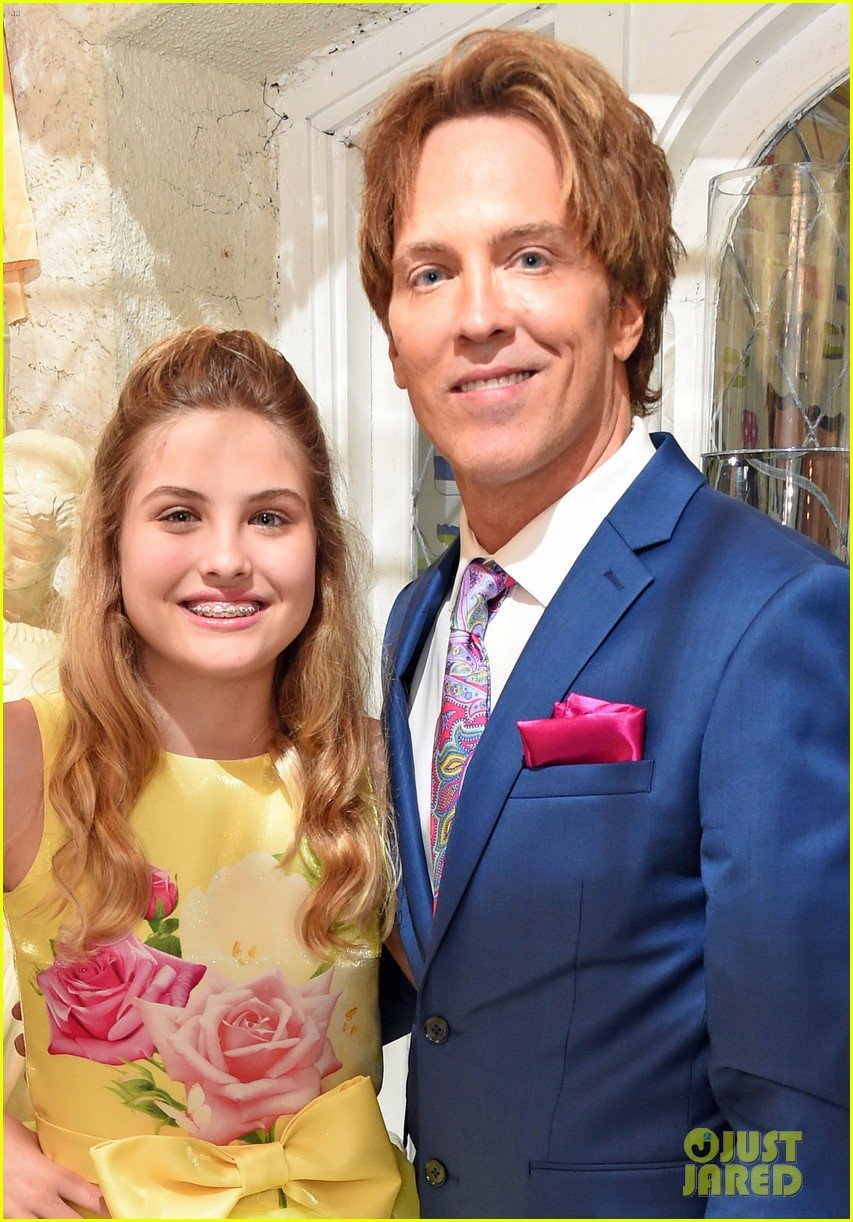

Extra image loans: Donald Trump (Chip Somodevilla/Getty Photographs), Liz Uihlein from Uline (Paul Morigi/Getty Photographs), Brendan Bechtel from Bechtel (Abdulrahman Abdullah/Bloomberg through Getty Images), Sen. John Cornyn (Sarah Silbiger/Getty Pictures), Sen. Ron Johnson (STR/NurPhoto through Getty Photos), Steven Roth out-of Vornado (Misha Friedman/Getty Pictures), Donald Bren off Irvine Providers (Jay L. Clendenin/La Moments through Getty Photos).

While the write vocabulary of your own expenses generated its ways through Congress, lawmakers friendly to billionaires as well as their lobbyists been able to nip and you may tuck and you will offer the bill to suit various unique communities. The new flurry out of midnight business and you will past-moment insertions away from code lead to an enormous redistribution away from wealth into the pockets off a select selection of family members, siphoning away massive amounts from inside the income tax money regarding the country’s coffers. It tale is based on lobbying and you may venture finance disclosures, Treasury Agency letters and you will calendars received as a result of an independence of data Work lawsuit, and you will private tax ideas.

Justin Elliott try an effective ProPublica journalist layer government and government responsibility

Johnson’s intervention inside was created to improve the bill’s already reasonable tax split for ticket-because of enterprises. The balance had welcome to have business owners to subtract doing 17.4% of the payouts. Due to Johnson waiting around, that profile was ultimately boosted in order to 20%.

Whom blogged the definition of – and you may and therefore lawmaker registered it – has been a much-discussed puzzle on income tax plan globe. ProPublica discovered that a good lobbyist whom struggled to obtain each other Bechtel and you may an industry trade classification possess stated borrowing on modification.

House Options Committee Chairman Kevin Brady, R-Tx, answered with a promise to do a whole lot more: “Senator – I highly consent we want to consistently improve the ticket-due to arrangements at every action. You’re good champion because of it.” Congress is not at the mercy of the new Versatility of information Act, but Treasury officials was basically duplicated into the email change.

The newest Trump tax bill lead a win so you can Duncan’s heirs. ProPublica’s analysis shows his five college students, exactly who own bet from the business, with her stated more than $150 million in deductions in 2018 by yourself. The fresh new tax provision to own “smaller businesses” got brought good windfall into the loved ones Forbes rated just like the 11th richest in the country.

97 total views, no views today